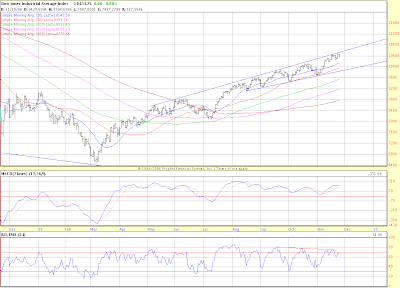

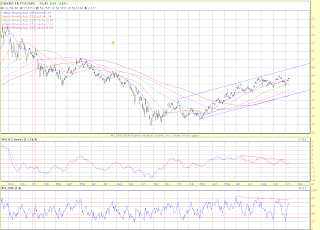

On wednesday USD has failed to break out after a good start in the american session. In my opinion, the current correction may go toward 100 days MA (moving average) with a strong support at 50 days MA around 76.

Thursday, December 31, 2009

Wednesday, December 23, 2009

The precious metals weakness

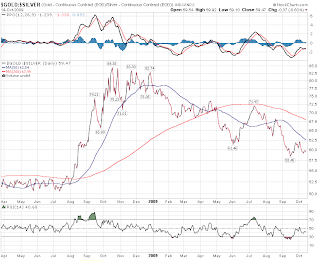

Precious metals are weak these times, breaking my preferred support levels of 108-109 on the ETF (GLD). Silver on Tuesday has confirmed the gold persistent weakness putting in a new low since this wave down has started. So, for now I'm considering highly probable the test of 100-102 range for the ETF GLD (1010-1030 for physical) and the down trend line (at 14.90) for the silver.

This impulse down bodes well with an expected continuation of the dollar strength. I don't see any meaningful correction before 81 is reached.

This impulse down bodes well with an expected continuation of the dollar strength. I don't see any meaningful correction before 81 is reached.

Friday, December 18, 2009

Tuesday, December 15, 2009

Risk aversion: another indicator

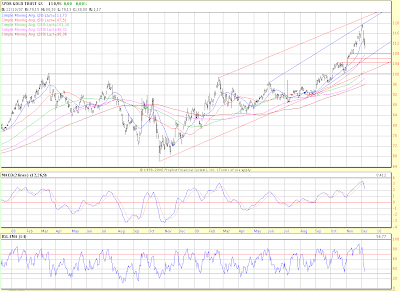

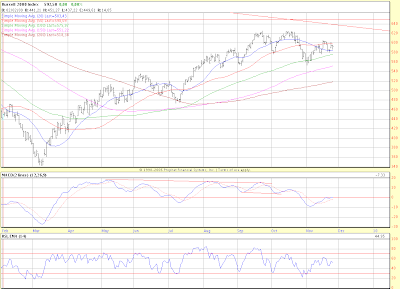

In a previous post I've already discussed one of my favorite risk aversion indicator in equity space : the Nasdaq to Dow ratio. Now I'd like to watch another important ratio: small capitalizations vs big ones. Small caps, as asset class, are considered to be more vulnerable to a recession, since they have more difficulties to get an access to cheap financing. Therefore, if we, as I expect, are heading in the 2nd dip of W-shaped recession, the small caps should show some weakness.

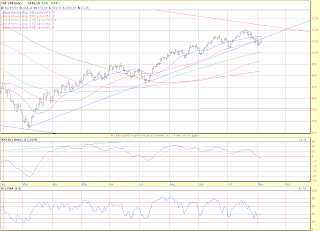

And it's what they do on the chart bellow. The charts shows the ratio of Russel 2000 (2000 medium to small capitalizations) to SP100 (hundred biggest US caps).

As we see, the rally off its lows has started well before the indexes their-self did it. And it has ended mid-September, a bit less than 10 months later. Since,we have drown a regular 1st wave down, signaling from the Elliott waves perspective the trend change.

If we apply the time the rally in the risk appetite has lasted to the SP500 or Dow indexes, we'll get the projection of their top for the year end, once again.

And it's what they do on the chart bellow. The charts shows the ratio of Russel 2000 (2000 medium to small capitalizations) to SP100 (hundred biggest US caps).

As we see, the rally off its lows has started well before the indexes their-self did it. And it has ended mid-September, a bit less than 10 months later. Since,we have drown a regular 1st wave down, signaling from the Elliott waves perspective the trend change.

If we apply the time the rally in the risk appetite has lasted to the SP500 or Dow indexes, we'll get the projection of their top for the year end, once again.

Monday, December 14, 2009

The first wave UP

My view on USD has finally worked out. The trend has changed and we've completed the first wave up.

The puzzle of different markets is slowly starting to assemble. The retrace of this first wave up for the USD has an excellent chance to coincide with the top in equities. Indeed, after the Dubai's rescue, what an event may strike the self-confidence of the market participants: Eastern Europe? Don't care, IMF will fix it. The party must be going on! Until it's over.

The puzzle of different markets is slowly starting to assemble. The retrace of this first wave up for the USD has an excellent chance to coincide with the top in equities. Indeed, after the Dubai's rescue, what an event may strike the self-confidence of the market participants: Eastern Europe? Don't care, IMF will fix it. The party must be going on! Until it's over.

Wednesday, December 9, 2009

A view on the precious metals

In the precious metals complex, I'm watching closely 3 components : gold, silver and the gold bug index HUI. Until the recent sell-off, the three have advanced more or less synchronously. Moreover, the run in the precious metals that preceded was real not only in US dollars, meaning the investors are scared of the (hyper)inflation on the global scale.

As the dollar has started to gather some strength, these hedges have been thrown away. But, as far as we continue to stay in "corrective mood" in the broad market, the things are, in my opinion, not done, especially for gold. The yellow metal's sell-off is looking much as a correction and I would expect gold to reverse from 108-109 range to push higher at the beginning of New Year as high as 126-132 for the ETF (GLD) or 1270-1330 for cash. Indeed, I would expect gold to make new historical highs as we enter the initial phase of the new wave down for stock indexes, it was already the case in the 4Q 2007 and 1Q 2008.

As the dollar has started to gather some strength, these hedges have been thrown away. But, as far as we continue to stay in "corrective mood" in the broad market, the things are, in my opinion, not done, especially for gold. The yellow metal's sell-off is looking much as a correction and I would expect gold to reverse from 108-109 range to push higher at the beginning of New Year as high as 126-132 for the ETF (GLD) or 1270-1330 for cash. Indeed, I would expect gold to make new historical highs as we enter the initial phase of the new wave down for stock indexes, it was already the case in the 4Q 2007 and 1Q 2008.

For the gold miners and the silver, the things are much trickier. They are more sensitive to the prospects of the broad stock market. And, in my opinion, they are far from being bright at this point.The gold bug index has stopped its advance right before the top of 2008, rising the probability of the double top.

The silver has reversed right under its Jul 08 minor top, nearly my preferred level of March 08 gap (19.40). I must say, that the whole advance in silver and HUI looks to me as corrective, since I can't rule out that their declines from the March 08' was in impulsive way.

So, my conclusion: the gold is very certainly correcting and will take new highs in the beginning of the 10', pushed by the deflationary forces. We may have the situation where gold and dollar move in the same direction. As for the gold stocks and silver, the situation is not easy, at least they will lag gold, creating the situation of non-confirmation.

Monday, December 7, 2009

Risk appetite and some confirmation

I've been expecting the techs to underperform the broad market and especially big caps well before the markets start to roll over. And that's what we have had.

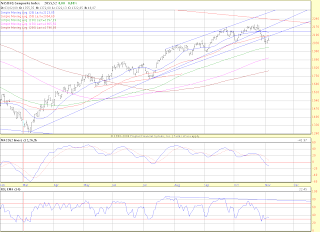

On the chart bellow we see the Nasdaq Composite to Dow Industrial Average ratio. It reflects the willingness of investors to buy riskier (more expensive on the relative basis) growth stocks. This ratio has put a top at the end of September and since, it has declined in the clear 5 waves pattern, meaning, from the Elliott waves point of view, the trend has changed.

So the rally in "risk appetite" has lasted a bit less than 10 months, and hence it confirms the coming reversal in the major averages (SPX, DOW) which will mark at the same time the beginning of the 3d wave down for the Nasdaq to Dow ratio.

Thursday, December 3, 2009

Want a bigger sallary? Pay back your debt.

While markets seemed to be happy with the news of BoA paying back government bailout funds, I think this event is not inflationary, especially for the dollar, - money are taking off the table and go back to their creator.

And, naturally, it's a good way to motivate other bank executives: "Wanna more money, pay back your debt".

And, naturally, it's a good way to motivate other bank executives: "Wanna more money, pay back your debt".

Santa rally, really?

What an entertainment to see bears turning bulls after the 60% rally. Yelnick has called "Wolf!" some times already since at least September, but finally he's calling for the Santa rally to the year end, and may be until February.

Oh, yeah, I understand, it's quite difficult to track any Elliott waves in the corrective crap the SPX or DOW are made of, so we start to imagine it was just an accumulative phase and we gonna explode on the upside.

Meantime, I don't see any reason for the averages to accelerate hence there are virtually no bears in the woods to hunt. Or, may be, still Pretcher, if he calls to cover his double short position, I will immediately put in the mine.

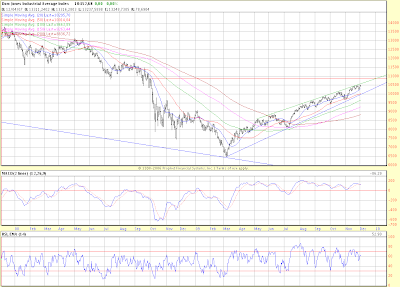

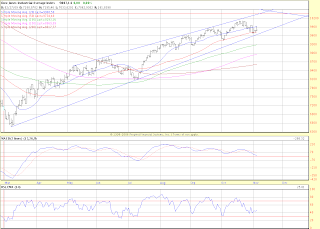

The best illustration is provided by the DOW: he's well as he is, drifting higher under the green line, enjoying the last weeks of this indian summer.

Oh, yeah, I understand, it's quite difficult to track any Elliott waves in the corrective crap the SPX or DOW are made of, so we start to imagine it was just an accumulative phase and we gonna explode on the upside.

Meantime, I don't see any reason for the averages to accelerate hence there are virtually no bears in the woods to hunt. Or, may be, still Pretcher, if he calls to cover his double short position, I will immediately put in the mine.

The best illustration is provided by the DOW: he's well as he is, drifting higher under the green line, enjoying the last weeks of this indian summer.

Labels:

Dow Industrial,

Elliott Waves,

Market Sentiment,

Market Trend

Wednesday, December 2, 2009

A tough call

In the time of rush on gold, I'd like to share my call on Silver:

We gonna put a top in coming days under the 08' highs, the most likely around 19.40 for the ETF (SLV). This top has a very good chance to stay for more than a year, and if the markets plunge in the second wave of deflation, as I expect, we'll see silver under 08' October's lows of 8.50.

We gonna put a top in coming days under the 08' highs, the most likely around 19.40 for the ETF (SLV). This top has a very good chance to stay for more than a year, and if the markets plunge in the second wave of deflation, as I expect, we'll see silver under 08' October's lows of 8.50.

Tuesday, December 1, 2009

A small check-up

It's how I would call the sell-off in risk assets that has followed Dubai's announcement. As a result of this check-up, - everything is in place and working: firstly sell emerging countries debt, stocks and currencies, simultaneously buy dollar and contracts on US government bonds. Fine, mission accomplished!

By its self, even the Dubai's default is far from being able to put in danger the world's financial system as it was the case with Lehman Brothers. What is more important it's the reminder to an average investor: "Ok, here in US, Europe, Japan, things are ugly and you can't earn anything on your money, but be careful when you go outside! Even if it looks great (as Dubai did) it can hurt badly and you'll loose about everything."

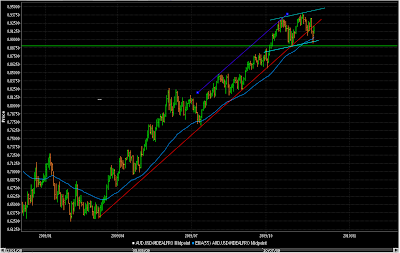

Now let's look at currencies. Bellow are two of them : the Euro, something like a big cap (of DOW Industrial index) and a "high beta small cap" - Australian dollar. And in this space the flight to quality is obvious.

As we can see for EUR/USD, the sell-off wasn't able to push bellow the red trend line. It's certainly a sign of strength and resilience for the single currency. Until this trend line resists we're still able to push higher, toward the upper trend line (1.537) . And seeing what is happening with gold, I consider it as a high probability event.

As for the Aussie, I'm happy that my call was confirmed. We have pierced and later busted the supportive red trend line as well as 55 days exponential moving average. That's serious. While AUD/USD have to go under 0.89 to confirm it's down trend, I think, before, it may take some time to consolidate in the 0.89-0.94 range.

By its self, even the Dubai's default is far from being able to put in danger the world's financial system as it was the case with Lehman Brothers. What is more important it's the reminder to an average investor: "Ok, here in US, Europe, Japan, things are ugly and you can't earn anything on your money, but be careful when you go outside! Even if it looks great (as Dubai did) it can hurt badly and you'll loose about everything."

Now let's look at currencies. Bellow are two of them : the Euro, something like a big cap (of DOW Industrial index) and a "high beta small cap" - Australian dollar. And in this space the flight to quality is obvious.

As we can see for EUR/USD, the sell-off wasn't able to push bellow the red trend line. It's certainly a sign of strength and resilience for the single currency. Until this trend line resists we're still able to push higher, toward the upper trend line (1.537) . And seeing what is happening with gold, I consider it as a high probability event.

As for the Aussie, I'm happy that my call was confirmed. We have pierced and later busted the supportive red trend line as well as 55 days exponential moving average. That's serious. While AUD/USD have to go under 0.89 to confirm it's down trend, I think, before, it may take some time to consolidate in the 0.89-0.94 range.

Thursday, November 26, 2009

So, getting exhausted?

Wednesday's dollar move has finally produced what I've been expecting since quite some time, - a spike on the downside. In my opinion it is one, indicating the trend is exhausting. The kind of spike which doesn't change anything technically and is seen barely as a beep on the long term charts, but at the moment is perceived by the trading public as a catastrophe: "we gonna crash!"

By the way, the 2 high yielding currencies I'm watching closely (kiwi and aussie) were far enough from confirming this exploit. Just may be they know something more about Chinese reflation and just may be that is more important than no more significant statements from the FED about long lasting low interest rates? Indeed, are we in the environment where the interest rates or the capital preservation matter more? I'm pretty sure in coming weeks we'll start to see the answer.

By the way, the 2 high yielding currencies I'm watching closely (kiwi and aussie) were far enough from confirming this exploit. Just may be they know something more about Chinese reflation and just may be that is more important than no more significant statements from the FED about long lasting low interest rates? Indeed, are we in the environment where the interest rates or the capital preservation matter more? I'm pretty sure in coming weeks we'll start to see the answer.

Wednesday, November 25, 2009

Watching the grass grow

While I've been expecting that this rally should last until the year-end I didn't think it would get so boring. I definitely prefer the tops of bull markets, with their spikes as early bears get squeezed.

Nasdaq Composite goes nowhere since 2 months already.

Hopefully, there is DOW, the big caps are still desired.

Nasdaq Composite goes nowhere since 2 months already.

And if you think we gonna break out on the upside, look at the high beta small caps Russel 2000:

And some of not so old leaders,

Homebuilders:

And Semiconductor Companies:

Ok, ok, I know, the real story is about Gold. There is a lot of action. People are scared by coming hyperinflation and are buying gold as if there is no tomorrow. Personally, I'm far from being sure , most of them really understand why they need gold, but it continues to be the game du jour until it's no more.

Labels:

Dow Industrial,

Homebuilders,

Nasdaq Composite,

R2K,

SOX

Friday, November 20, 2009

"Les carrotes sont cuites"

That is coming to my mind right now, - a famous french expression which was a code message to the French Resistance (to start their operations), broadcasted by BBC before the allied invasion of Normandy.

Thursday, November 19, 2009

Dollar's turning point?

So hated dollar started to show some strength in recent hours. Already, EUR/USD failed to put in new highs while USD index established new lows. Indeed, index was pushed by the strength of other currencies, among which I would cite Australian dollar, the biggest beneficiary of the reflation process.

Is this weakness real? I think, in any case, AUD/USD must be watched seriously as an indicator par excellence of the Chinese part of reflation. And let's not forget, that at 0.94, AUD /USD is just within 4 cents from the '08 high, - about a perfect shorting opportunity for someone who does believe in the near end of this fiesta.

Is this weakness real? I think, in any case, AUD/USD must be watched seriously as an indicator par excellence of the Chinese part of reflation. And let's not forget, that at 0.94, AUD /USD is just within 4 cents from the '08 high, - about a perfect shorting opportunity for someone who does believe in the near end of this fiesta.

Friday, November 13, 2009

USD: noise and reality

Lotta noise on dollar's fate recently may hide the real story in the process of making. The dollar is the main funding currency in the world. Trillions of liabilities are dollar denominated and should be payed back in dollars as well. Under the light of the private credit contraction, I think it's the time to take seriously the long ago discussed theory of the Synthetic Short Dollar. I remember, when gold bugs were criticizing the theory as something impossible due to the fact that a genuine deflation in US is impossible. And, really, the Fed and US government did all they could to stop the deflation. Did they succeed? The time will show. But we must take in account that they had a good ally - China. Being pegged to USD, the RMB credit expansion has amplified the American reflationary attempt. Moreover, I would even think that it's the Chinese who have reflated the World economy and only because of the peg we have felt it as a dollar reflation. Since this reflation attempt is clearly slowing in the US and China, one could suppose that, US and China deflationary forces will strike back with the vengeance and hence the dollar will rise. It's exactly what the USD index chart suggests:

The bottoming process, in my opinion, is clearly underway. Should we break out the blue trend line, a sharp rally will ensue with very certainly higher than 90 as target. Of course, that rally will go along with a massive stocks and low quality debt liquidation.

The bottoming process, in my opinion, is clearly underway. Should we break out the blue trend line, a sharp rally will ensue with very certainly higher than 90 as target. Of course, that rally will go along with a massive stocks and low quality debt liquidation.

So, we're about done

Looking at markets' recent action, I've been feeling something like nostalgia. Really, it's such a beautiful moment. The one where you clearly see that all these "green shoots" are fake, but somewhere deeply inside you're enjoying it and would like it to continue as long as possible, just like we enjoy a sunny November day, here in Paris, knowing that the next 3 months it's gonna be rainy and cold.

As for me, I will very certainly associate this Indian summer with the biggest french retailer Carrefour publicity campaign : "Le positif est de retour" (The positive is back). Never before, I've seen so much rebated brand products and rebate coupons as during this campaign, - certainly because of a lot of money in the clients pockets and positive mood in general.

So, in my opinion, we should put in a top next week on cash SPX at about 1114-1125. The plunge under 1029 which should follow, will mark the end of this rally. As for Nasdaq Composite, I'm still skeptical about it's ability to make new highs (above 2190.64).

As for me, I will very certainly associate this Indian summer with the biggest french retailer Carrefour publicity campaign : "Le positif est de retour" (The positive is back). Never before, I've seen so much rebated brand products and rebate coupons as during this campaign, - certainly because of a lot of money in the clients pockets and positive mood in general.

So, in my opinion, we should put in a top next week on cash SPX at about 1114-1125. The plunge under 1029 which should follow, will mark the end of this rally. As for Nasdaq Composite, I'm still skeptical about it's ability to make new highs (above 2190.64).

Labels:

Market Sentiment,

Market Trend,

Social mood,

SPX

Thursday, November 12, 2009

3 possible scenario for the next wave of crisis

Seeking Alpha publishes an interesting article on 3 possible ways the next wave of crisis will play out.

In brief they analyze 3 scenario :

Deflationary: dollar and bonds rise, stocks fall.

Inflationary: dollar and bonds continue to fall, stocks continue to rise. In one word: more of what we have already, and that's precisely why, in my opinion, it's the least probable: at present, the real economy and financial markets are going in the different directions.

Hyperinflationary: all paper instruments fall destroying the economy as we know.

A simple analysis of some recent trends gives a higher chances for the 1st scenario. It's my opinion as well.

In brief they analyze 3 scenario :

Deflationary: dollar and bonds rise, stocks fall.

Inflationary: dollar and bonds continue to fall, stocks continue to rise. In one word: more of what we have already, and that's precisely why, in my opinion, it's the least probable: at present, the real economy and financial markets are going in the different directions.

Hyperinflationary: all paper instruments fall destroying the economy as we know.

A simple analysis of some recent trends gives a higher chances for the 1st scenario. It's my opinion as well.

Labels:

Deflation,

Hyperinflation,

Inflation,

Market Sentiment,

Market Trend,

USD

Tuesday, November 10, 2009

It's a final count down

So, a pretty strong day for the beginning of the week.

Patterns are in process of completing: Dow and XMI have put in new recovery highs, which was quite expected. Also, the inflation related stuff was pretty strong, as an example, the brazilian ETF has hit at new high as well. But silver wasn't impressive, unwilling to follow gold to new highs and that despite the dollar weakness.

To resume: the liquidity is dissipating, but the psychology is another matter.

Patterns are in process of completing: Dow and XMI have put in new recovery highs, which was quite expected. Also, the inflation related stuff was pretty strong, as an example, the brazilian ETF has hit at new high as well. But silver wasn't impressive, unwilling to follow gold to new highs and that despite the dollar weakness.

To resume: the liquidity is dissipating, but the psychology is another matter.

Monday, November 9, 2009

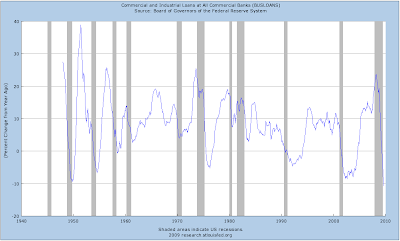

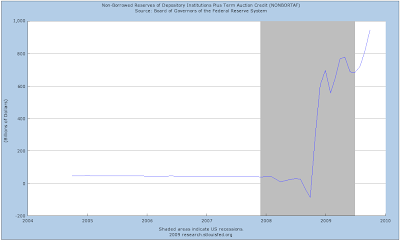

The recession has ended, but US banks don't take it seriously

A strange thing is happenning in US bank sector. The recession has ended, but banks are still reducing their loans to the real economy:

And they rise their reserves as if there is no tomorrow:

Really strange, if we look at previous recessions ends. Or may be, they just think there is still too much risk in the system.

And they rise their reserves as if there is no tomorrow:

Really strange, if we look at previous recessions ends. Or may be, they just think there is still too much risk in the system.

Friday, November 6, 2009

China goes CDO

Caijing is reporting the slowdown in the big banks landing and shifting in new loan issues to smaller banks and rural credit unions. What a deja vu of Eastern Europe!

But the most interesting, in my opinion, are the packaging efforts of western bankers and spreading of financial services in non-financial firms:

But the most interesting, in my opinion, are the packaging efforts of western bankers and spreading of financial services in non-financial firms:

Now, said a banker at a joint-stock bank, the latest trend is to bundle loans for wealth management packages.

Trust products are another increasingly popular type of investment playing a role in the credit shift. Banks have transferred credit assets to financial firms through trust companies, which then issue trust products that are in turn purchased by financial firms.Good luck China!

In this way, data indicate that finance companies are taking up the loan torch with enthusiasm. In September, financial firms issued 87 billion yuan in new loans, representing nearly 17 percent of total credit issued by all financial institutions and second only to the Big Four.

That marked a major change since August, when financial firms accounted for only 5.5 percent of all credit lending in China, issuing loans worth a combined 22.8 billion yuan.

Financial companies are generally attached to large enterprise groups. They mainly service capital pools held by the groups while focusing on intra-group financial needs.

A source at the petroleum financial subsidiary attached to China National Petroleum Corp. said the credit business at these companies includes proprietary lending and agent commissioned loans, all serving businesses within the group.

According to the central bank, agent commissioned loans are classified as trust loans, and include both loans issued by trust companies as well as agent commissioned loans issued by financial firms.

Financial firms also can receive credit assets transferred from banks. But, technically, financial firms and banks should sign buy-back credit asset transferring agreements.

Thursday, November 5, 2009

Sell the news

The Fed was as dovish as they ever could, but we didn't managed to hold. Looking at the charts, I think the lows of 1027 (on December's SPX) should hold in the comming days. What we have seen yesterday was the most likely wave A for those in the correction (semis, Nasdaq, small caps) and the wave (i) for, at least, Dow Industrial.

Looking bellow at charts of Dow, SPX and Nasdaq Composite we can see that only Dow didn't violate the trend line from the March lows. Moreover, Nasdaq has already put in a lower low, but it's not the case of 2 other indexes.

So, I'm still sticking to my Nasdaq's count, but may be with the correction about the year end. As for now, markets look a bit weaker than I've been expecting, so the top of this correction wave (since July's low) is closer and if this wave is the final one (I believe so) at year end we will be significantly lower than even now.

May be a disappointing shopping season in the US and Europe will be a nail in this rally's coffin.

Looking bellow at charts of Dow, SPX and Nasdaq Composite we can see that only Dow didn't violate the trend line from the March lows. Moreover, Nasdaq has already put in a lower low, but it's not the case of 2 other indexes.

So, I'm still sticking to my Nasdaq's count, but may be with the correction about the year end. As for now, markets look a bit weaker than I've been expecting, so the top of this correction wave (since July's low) is closer and if this wave is the final one (I believe so) at year end we will be significantly lower than even now.

May be a disappointing shopping season in the US and Europe will be a nail in this rally's coffin.

Labels:

Dow Industrial,

Elliott Count,

FED,

Nasdaq Composite,

SPX

Wednesday, November 4, 2009

Running with bulls

No surprise, we're rallying ahead of the Fed decision. Just as many times before, since the bear has begun. Go ahead, load the mull and run with bulls, it's still an Indian summer, and the Fed won't disappoint until it won't matter anymore.

So, where to go now?

Tuesdays we had an often played situation with the Europe sinking (on the come back of bank worries) the first half of the session while SPX future was retesting previous day lows at around 1027.

And after the retest the Buffett's bet news had hit the tape. I've written recently that in my opinion the trend for transports have changed and I'm sticking with that view. While railroads may have a bright future in the long run, due to changes in the way we transport goods and travel our-self, the current situation and perspectives are far from being a bright spot.

As for the nearest future in other markets, I believe that we have finished the correction for some and the first impulsive wave down for others. It will be interesting to see the quality of the rebound. The leadership is clearly changed since the techs and especially semis as well as most financials are no more. So I think some good upside is still in cards for inflation related stuff (gold and silver are leaders as usual), especially if Benny doesn't disappoint markets with his words about exit strategy.

And after the retest the Buffett's bet news had hit the tape. I've written recently that in my opinion the trend for transports have changed and I'm sticking with that view. While railroads may have a bright future in the long run, due to changes in the way we transport goods and travel our-self, the current situation and perspectives are far from being a bright spot.

As for the nearest future in other markets, I believe that we have finished the correction for some and the first impulsive wave down for others. It will be interesting to see the quality of the rebound. The leadership is clearly changed since the techs and especially semis as well as most financials are no more. So I think some good upside is still in cards for inflation related stuff (gold and silver are leaders as usual), especially if Benny doesn't disappoint markets with his words about exit strategy.

Monday, November 2, 2009

The wind of change

So, the expected correction has finally started and, as for me, did the most of its job last week. In my opinion the trend change is now confirmed for semis, small caps, home builders and transports. For Nasdaq my scenario seems to be followed with an exception of starting point. The only broad group where the top is clearly not in are big caps with DOW Industrial and XMI as benchmark indexes.

For inflation related stuff things are a bit trickier. On one side the GSR (Gold to Silver Ratio) indicates the bottom is in.

On another, gold price and USD index charts still looks uncompleted. The same story for emerging markets ETFs. They had such a strong momentum before the correction has begun, that I can't see them not to make new highs before we'll actually roll over.

For inflation related stuff things are a bit trickier. On one side the GSR (Gold to Silver Ratio) indicates the bottom is in.

On another, gold price and USD index charts still looks uncompleted. The same story for emerging markets ETFs. They had such a strong momentum before the correction has begun, that I can't see them not to make new highs before we'll actually roll over.

Labels:

DOW Transportation,

Emerging Markets,

Gold,

GSR,

Homebuilders,

Market Sentiment,

Market Trend,

R2K,

Silver,

SOX,

USD

Friday, October 23, 2009

A close look at CPI

The chart bellow shows the evolution of CPI its self and some important components of US consumer prices index (CPI): Apparel, Energy, Food and Beverages, Housing (Rent), Transportation and Health Care.

Can we say, that in years to come 2 most distant components (Health Care and Apparel) will move toward the mean?

Can we say, that in years to come 2 most distant components (Health Care and Apparel) will move toward the mean?

Terra of Uncertainty

Precious metals continue to disappoint, while USD continue to sink. Looking at charts of gold and silver, it seems that we didn't complete the movement and have to push a bit higher. At the same time gold to silver ratio remains in the area of uncertainty

Should we cross the blue line and it will send a warning that liquidity is dissipating and the risk assets will be put under pressure.

In the equity space, big caps continue to outperform small ones and techs have clearly lost their leadership. Investors are still bidding stocks, but becoming more defensive.

Should we cross the blue line and it will send a warning that liquidity is dissipating and the risk assets will be put under pressure.

In the equity space, big caps continue to outperform small ones and techs have clearly lost their leadership. Investors are still bidding stocks, but becoming more defensive.

Thursday, October 22, 2009

Missed!

What a pity, the Composite missed the target of 2200 by less than 10 points. Hopefully, FX market gives us a chance to have another attempt before the real correction starts. In fact, USD is still looking like going to spike toward 74. That shall give ~1.52 target for EUR.

The volatility has suffered a powerful reversal following the sell off, but such a thing often needs a retest.

The volatility has suffered a powerful reversal following the sell off, but such a thing often needs a retest.

Labels:

Euro,

Market Trend,

Nasdaq Composite,

USD,

VIX,

VXX

Wednesday, October 21, 2009

Leaving the techs alone

While still waiting for a thrust to at least 2200, I'm looking at the Nasdaq to Dow Jones ratio.

For the intermediate bottom, it has turned up well before the indexes actually did. So, now I will look at it in order to confirm the trend change as well. And, as for now, the ratio seems to be poised to plunge.

For the intermediate bottom, it has turned up well before the indexes actually did. So, now I will look at it in order to confirm the trend change as well. And, as for now, the ratio seems to be poised to plunge.

Tuesday, October 20, 2009

Mish on USD and Gold

An excellent post from Mish about the US dollar and Gold and where we're with it. Just wanted to correct his thoughts about the European banks:

1) European banks are arguably in as bad a shape as US banks because of loans to Latin America and the Baltic states.

We should add a higher level of leverage of European banks if compared with their American peers. The loans were given to the whole Eastern Europe, not only Baltic states. Much of them were spent on real estate speculations of all sorts and the bear market in many countries has barely begun. The problems in continental Europe exist as well but we didn't even see the beginning of their resolution. I'm very bearish on the European bank system in the long run and hence on the Euro its self.

Will the single currency become the deception of 2010?

1) European banks are arguably in as bad a shape as US banks because of loans to Latin America and the Baltic states.

We should add a higher level of leverage of European banks if compared with their American peers. The loans were given to the whole Eastern Europe, not only Baltic states. Much of them were spent on real estate speculations of all sorts and the bear market in many countries has barely begun. The problems in continental Europe exist as well but we didn't even see the beginning of their resolution. I'm very bearish on the European bank system in the long run and hence on the Euro its self.

Will the single currency become the deception of 2010?

How a real bottom may look like

After Google, Apple has delivered an excellent quarter, - hardly a surprise for those who plays with i-phones. Hopefully this news will squeeze some shorts and push Nasdaq Composite over 2200.

Now, I'd like to look at some long term charts. Do you know a lot of stock market indexes which have exceeded during this rally the levels of the summer '08. It's quite simple, an airline index which has sold off hardly during the last year oil run to over $140 a barrel, so the last summer they were already in ashes.

And if we look at the long time charts? Does this look like a long term bottom is in?

Now, I'd like to look at some long term charts. Do you know a lot of stock market indexes which have exceeded during this rally the levels of the summer '08. It's quite simple, an airline index which has sold off hardly during the last year oil run to over $140 a barrel, so the last summer they were already in ashes.

And if we look at the long time charts? Does this look like a long term bottom is in?

Monday, October 19, 2009

Elliott wave count for Nasdaq

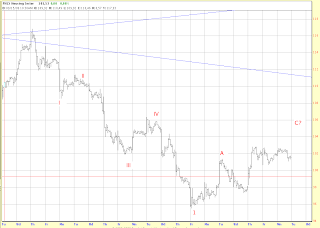

Previously, I've given a target for the Composite of around 2200-2270. Now it's time to enter in some details. Firstly, the current count for the Nasdaq Composite.

I think this correction of the entire wave 1 will not exceed 61.8%. Playing with fractals, we'll find that at the beginning of this bear market not the 1st of I nor the wave I were retraced more than 61.8%.

As for the timing, in both previous cases of 1st waves, the correction has lasted about 61.8% of the impulsive wave. That gives us a target for the year-end. But, since we're already near an important juncture, I think we'll get Nasdaq topping in few days and other broad indexes (SPX, DOW, XMI) doing so in December, while Nasdaq will make a double top.

I think this correction of the entire wave 1 will not exceed 61.8%. Playing with fractals, we'll find that at the beginning of this bear market not the 1st of I nor the wave I were retraced more than 61.8%.

Thursday, October 15, 2009

Complacency and Confidence

The words associated with Wednesday's session.

The broad indexes are approaching critical levels of resistance, Intel beats the Street and ends near the lowest level of the day, - to say this performance was largely anticipated. The volatility index (VIX) make new lows, showing there really isn't much fear in this market. AlphaTrader has initiated a long position in volatility via VXX with a goal to stabilize the whole portfolio in case, just in case, everything is not that good the market seems to believe.

Silver and Gold were quite disappointing, failing to advance in this risk and inflation friendly environment. Looking at my favorite chart of gold to silver ratio, I find it looks indecisive at the moment.

To complete the pattern, the ratio should go at least to 55, which would give us 20 bucks silver with, say, 1100 bucks gold. In fact, the task is not impossible, given the current weakness in USD which, in my opinion, should shortly land around 74

Will precious metals anticipate the bottoming USD and decline in advance or will we have a spike provoked by the fear of the global inflation. Despite the appearance, this market becomes very tricky. The gold to silver ratio is the thing to watch very closely.

The broad indexes are approaching critical levels of resistance, Intel beats the Street and ends near the lowest level of the day, - to say this performance was largely anticipated. The volatility index (VIX) make new lows, showing there really isn't much fear in this market. AlphaTrader has initiated a long position in volatility via VXX with a goal to stabilize the whole portfolio in case, just in case, everything is not that good the market seems to believe.

Silver and Gold were quite disappointing, failing to advance in this risk and inflation friendly environment. Looking at my favorite chart of gold to silver ratio, I find it looks indecisive at the moment.

Will precious metals anticipate the bottoming USD and decline in advance or will we have a spike provoked by the fear of the global inflation. Despite the appearance, this market becomes very tricky. The gold to silver ratio is the thing to watch very closely.

Tuesday, October 13, 2009

Inflation's run

No surprise, inflation related staff is the best place to be at the moment. Just look at the chart of Brazilian ETF:

And the Russian one:

And, in contrast, the Chinese ETF clearly shows some signs of fatigue.

May we say : what is good for Russians is bad for Chinese?

As for the US stocks, the trend is about the same: energy stocks are clear outperformers of the broad market, especially if compared to transports and home builders. For last 2 ones I wouldn't be surprised if the tops are already in. In fact, the decline of DOW Transportation and Homebuilders indexes has unfolded in 5 waves from the top, meaning from the Elliott's wave perspective the trend has changed:

Labels:

DOW Transportation,

Elliott Count,

Elliott Waves,

Emerging Markets,

EWZ,

FXI,

Homebuilders,

Market Trend,

RSX

Monday, October 12, 2009

Are small caps weakening?

As was expected, the big caps are the leaders of this new wave up. The XMI - Major Market Index (20 biggest capitalizations) has closed last Friday at new cyclical high, while others (Nasdaq, SP500) are a bit lower.

An interesting chart for small caps - RUSSEL2000. We're approaching the previously strong support level of 650. So looking at the weakening momentum, it seems to be a good shorting entry point.

An interesting chart for small caps - RUSSEL2000. We're approaching the previously strong support level of 650. So looking at the weakening momentum, it seems to be a good shorting entry point.

Friday, October 9, 2009

Will SOX suck this time?

Another index I'm watching closely: Semiconductors or SOX. For those who are too young in the markets, SOX is one of the components the tech. bubble of 00' was made of. Since, it has lost its luster, but in some opinions still remains an advanced indicator of economical growth since an economic contraction makes the inventories of semi companies grow and their earnings (usually based on big margins) plunge.

SOX has landed in Nov' 08, and since then has almost doubled. Now It looks indecisive about further movements up, lagging Nasdaq in its latest attempt to rally.

SOX has landed in Nov' 08, and since then has almost doubled. Now It looks indecisive about further movements up, lagging Nasdaq in its latest attempt to rally.

Thursday, October 8, 2009

Is Gold the best hedge against the inflation?

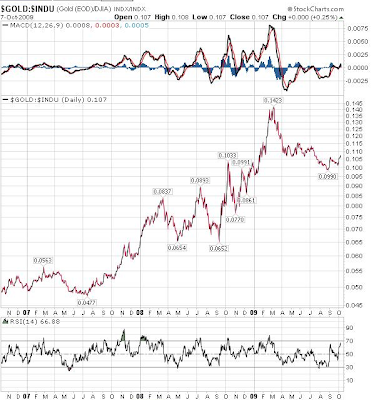

My positive opinion on precious metals has materialized in the new historical highs for gold and cyclical for silver. The public attention has been largely attracted by the gold installing above 1000 dollars mark. As for me, I'm happy with just new cyclical highs in silver. Really, is the gold the best hedger against the inflation (or should we say reflation) where we are supposed to be ?

Looking at gold to silver ratio we see that gold is a strong outperformer in a deflationary environment, as the one we have experienced last fall. Since the reflation policy has started to work, the silver has started to outperform gold.

Looking at gold to silver ratio we see that gold is a strong outperformer in a deflationary environment, as the one we have experienced last fall. Since the reflation policy has started to work, the silver has started to outperform gold.

We can even try to judge the "quality" of the reflation policy regarding the eurozone on the chart with gold priced in euros: the recent top in dollar is far from confirmation.

Or to find which country is the biggest bénéficier of the policy of global reflation, looking at gold priced in Australian dollars:

Even Dow has managed to do better since the reflation attempt has begun:

So, my conclusion is that gold as well as cash is the best investment during the periods of credit stress which we have seen during second half of 2008 and 1Q of 2009. But for the period of "reflation" gold under performs other assets (except cash) and will even further under perform silver should we enter a period of higher inflation.

Subscribe to:

Posts (Atom)