The chart bellow shows the evolution of CPI its self and some important components of US consumer prices index (CPI): Apparel, Energy, Food and Beverages, Housing (Rent), Transportation and Health Care.

Can we say, that in years to come 2 most distant components (Health Care and Apparel) will move toward the mean?

Friday, October 23, 2009

Terra of Uncertainty

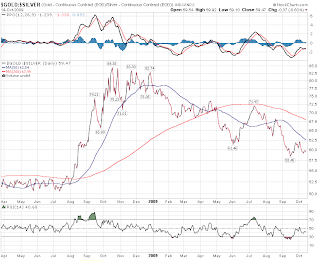

Precious metals continue to disappoint, while USD continue to sink. Looking at charts of gold and silver, it seems that we didn't complete the movement and have to push a bit higher. At the same time gold to silver ratio remains in the area of uncertainty

Should we cross the blue line and it will send a warning that liquidity is dissipating and the risk assets will be put under pressure.

In the equity space, big caps continue to outperform small ones and techs have clearly lost their leadership. Investors are still bidding stocks, but becoming more defensive.

Should we cross the blue line and it will send a warning that liquidity is dissipating and the risk assets will be put under pressure.

In the equity space, big caps continue to outperform small ones and techs have clearly lost their leadership. Investors are still bidding stocks, but becoming more defensive.

Thursday, October 22, 2009

Missed!

What a pity, the Composite missed the target of 2200 by less than 10 points. Hopefully, FX market gives us a chance to have another attempt before the real correction starts. In fact, USD is still looking like going to spike toward 74. That shall give ~1.52 target for EUR.

The volatility has suffered a powerful reversal following the sell off, but such a thing often needs a retest.

The volatility has suffered a powerful reversal following the sell off, but such a thing often needs a retest.

Labels:

Euro,

Market Trend,

Nasdaq Composite,

USD,

VIX,

VXX

Wednesday, October 21, 2009

Leaving the techs alone

While still waiting for a thrust to at least 2200, I'm looking at the Nasdaq to Dow Jones ratio.

For the intermediate bottom, it has turned up well before the indexes actually did. So, now I will look at it in order to confirm the trend change as well. And, as for now, the ratio seems to be poised to plunge.

For the intermediate bottom, it has turned up well before the indexes actually did. So, now I will look at it in order to confirm the trend change as well. And, as for now, the ratio seems to be poised to plunge.

Tuesday, October 20, 2009

Mish on USD and Gold

An excellent post from Mish about the US dollar and Gold and where we're with it. Just wanted to correct his thoughts about the European banks:

1) European banks are arguably in as bad a shape as US banks because of loans to Latin America and the Baltic states.

We should add a higher level of leverage of European banks if compared with their American peers. The loans were given to the whole Eastern Europe, not only Baltic states. Much of them were spent on real estate speculations of all sorts and the bear market in many countries has barely begun. The problems in continental Europe exist as well but we didn't even see the beginning of their resolution. I'm very bearish on the European bank system in the long run and hence on the Euro its self.

Will the single currency become the deception of 2010?

1) European banks are arguably in as bad a shape as US banks because of loans to Latin America and the Baltic states.

We should add a higher level of leverage of European banks if compared with their American peers. The loans were given to the whole Eastern Europe, not only Baltic states. Much of them were spent on real estate speculations of all sorts and the bear market in many countries has barely begun. The problems in continental Europe exist as well but we didn't even see the beginning of their resolution. I'm very bearish on the European bank system in the long run and hence on the Euro its self.

Will the single currency become the deception of 2010?

How a real bottom may look like

After Google, Apple has delivered an excellent quarter, - hardly a surprise for those who plays with i-phones. Hopefully this news will squeeze some shorts and push Nasdaq Composite over 2200.

Now, I'd like to look at some long term charts. Do you know a lot of stock market indexes which have exceeded during this rally the levels of the summer '08. It's quite simple, an airline index which has sold off hardly during the last year oil run to over $140 a barrel, so the last summer they were already in ashes.

And if we look at the long time charts? Does this look like a long term bottom is in?

Now, I'd like to look at some long term charts. Do you know a lot of stock market indexes which have exceeded during this rally the levels of the summer '08. It's quite simple, an airline index which has sold off hardly during the last year oil run to over $140 a barrel, so the last summer they were already in ashes.

And if we look at the long time charts? Does this look like a long term bottom is in?

Monday, October 19, 2009

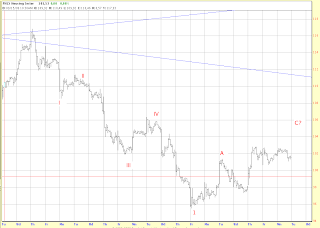

Elliott wave count for Nasdaq

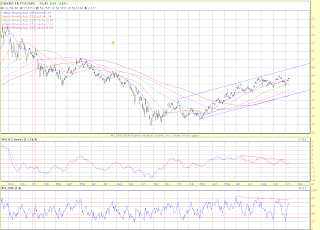

Previously, I've given a target for the Composite of around 2200-2270. Now it's time to enter in some details. Firstly, the current count for the Nasdaq Composite.

I think this correction of the entire wave 1 will not exceed 61.8%. Playing with fractals, we'll find that at the beginning of this bear market not the 1st of I nor the wave I were retraced more than 61.8%.

As for the timing, in both previous cases of 1st waves, the correction has lasted about 61.8% of the impulsive wave. That gives us a target for the year-end. But, since we're already near an important juncture, I think we'll get Nasdaq topping in few days and other broad indexes (SPX, DOW, XMI) doing so in December, while Nasdaq will make a double top.

I think this correction of the entire wave 1 will not exceed 61.8%. Playing with fractals, we'll find that at the beginning of this bear market not the 1st of I nor the wave I were retraced more than 61.8%.

Thursday, October 15, 2009

Complacency and Confidence

The words associated with Wednesday's session.

The broad indexes are approaching critical levels of resistance, Intel beats the Street and ends near the lowest level of the day, - to say this performance was largely anticipated. The volatility index (VIX) make new lows, showing there really isn't much fear in this market. AlphaTrader has initiated a long position in volatility via VXX with a goal to stabilize the whole portfolio in case, just in case, everything is not that good the market seems to believe.

Silver and Gold were quite disappointing, failing to advance in this risk and inflation friendly environment. Looking at my favorite chart of gold to silver ratio, I find it looks indecisive at the moment.

To complete the pattern, the ratio should go at least to 55, which would give us 20 bucks silver with, say, 1100 bucks gold. In fact, the task is not impossible, given the current weakness in USD which, in my opinion, should shortly land around 74

Will precious metals anticipate the bottoming USD and decline in advance or will we have a spike provoked by the fear of the global inflation. Despite the appearance, this market becomes very tricky. The gold to silver ratio is the thing to watch very closely.

The broad indexes are approaching critical levels of resistance, Intel beats the Street and ends near the lowest level of the day, - to say this performance was largely anticipated. The volatility index (VIX) make new lows, showing there really isn't much fear in this market. AlphaTrader has initiated a long position in volatility via VXX with a goal to stabilize the whole portfolio in case, just in case, everything is not that good the market seems to believe.

Silver and Gold were quite disappointing, failing to advance in this risk and inflation friendly environment. Looking at my favorite chart of gold to silver ratio, I find it looks indecisive at the moment.

Will precious metals anticipate the bottoming USD and decline in advance or will we have a spike provoked by the fear of the global inflation. Despite the appearance, this market becomes very tricky. The gold to silver ratio is the thing to watch very closely.

Tuesday, October 13, 2009

Inflation's run

No surprise, inflation related staff is the best place to be at the moment. Just look at the chart of Brazilian ETF:

And the Russian one:

And, in contrast, the Chinese ETF clearly shows some signs of fatigue.

May we say : what is good for Russians is bad for Chinese?

As for the US stocks, the trend is about the same: energy stocks are clear outperformers of the broad market, especially if compared to transports and home builders. For last 2 ones I wouldn't be surprised if the tops are already in. In fact, the decline of DOW Transportation and Homebuilders indexes has unfolded in 5 waves from the top, meaning from the Elliott's wave perspective the trend has changed:

Labels:

DOW Transportation,

Elliott Count,

Elliott Waves,

Emerging Markets,

EWZ,

FXI,

Homebuilders,

Market Trend,

RSX

Monday, October 12, 2009

Are small caps weakening?

As was expected, the big caps are the leaders of this new wave up. The XMI - Major Market Index (20 biggest capitalizations) has closed last Friday at new cyclical high, while others (Nasdaq, SP500) are a bit lower.

An interesting chart for small caps - RUSSEL2000. We're approaching the previously strong support level of 650. So looking at the weakening momentum, it seems to be a good shorting entry point.

An interesting chart for small caps - RUSSEL2000. We're approaching the previously strong support level of 650. So looking at the weakening momentum, it seems to be a good shorting entry point.

Friday, October 9, 2009

Will SOX suck this time?

Another index I'm watching closely: Semiconductors or SOX. For those who are too young in the markets, SOX is one of the components the tech. bubble of 00' was made of. Since, it has lost its luster, but in some opinions still remains an advanced indicator of economical growth since an economic contraction makes the inventories of semi companies grow and their earnings (usually based on big margins) plunge.

SOX has landed in Nov' 08, and since then has almost doubled. Now It looks indecisive about further movements up, lagging Nasdaq in its latest attempt to rally.

SOX has landed in Nov' 08, and since then has almost doubled. Now It looks indecisive about further movements up, lagging Nasdaq in its latest attempt to rally.

Thursday, October 8, 2009

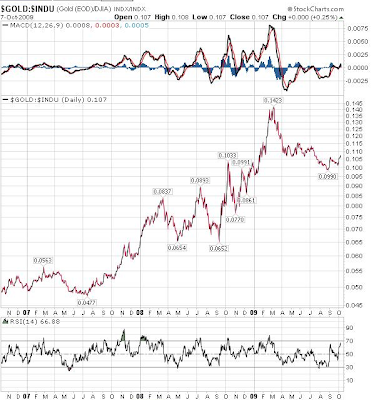

Is Gold the best hedge against the inflation?

My positive opinion on precious metals has materialized in the new historical highs for gold and cyclical for silver. The public attention has been largely attracted by the gold installing above 1000 dollars mark. As for me, I'm happy with just new cyclical highs in silver. Really, is the gold the best hedger against the inflation (or should we say reflation) where we are supposed to be ?

Looking at gold to silver ratio we see that gold is a strong outperformer in a deflationary environment, as the one we have experienced last fall. Since the reflation policy has started to work, the silver has started to outperform gold.

Looking at gold to silver ratio we see that gold is a strong outperformer in a deflationary environment, as the one we have experienced last fall. Since the reflation policy has started to work, the silver has started to outperform gold.

We can even try to judge the "quality" of the reflation policy regarding the eurozone on the chart with gold priced in euros: the recent top in dollar is far from confirmation.

Or to find which country is the biggest bénéficier of the policy of global reflation, looking at gold priced in Australian dollars:

Even Dow has managed to do better since the reflation attempt has begun:

So, my conclusion is that gold as well as cash is the best investment during the periods of credit stress which we have seen during second half of 2008 and 1Q of 2009. But for the period of "reflation" gold under performs other assets (except cash) and will even further under perform silver should we enter a period of higher inflation.

Tuesday, October 6, 2009

Dollar's demise: again, here we are

Put aside that discussions about dollar's demise are the most active exactly around important USD bottoms , here's an excellent reminder about the questions of pricing anything in any currencies.

The most important conclusion :

Dollars are held (or not held) for reasons totally unrelated to pricing unit. Some of those reasons are political, some are based on sentiment, some on trade patterns and trade relationships, and some to suppress the value of local currencies to improve exports.

The most important conclusion :

Dollars are held (or not held) for reasons totally unrelated to pricing unit. Some of those reasons are political, some are based on sentiment, some on trade patterns and trade relationships, and some to suppress the value of local currencies to improve exports.

No Top is in, yet

So, it seems, it's a bit frustrating to be a bear theese days.

Yelnick and a lot of other elliottists have reiterated recently "last chance to exit" calls, but no chance, we haven't entered the first wave down, yet, - it's only a zig zag correction. Indeed, it would be surprising to start a new leg down a priori without any notable non confirmation signs. Hopefully, during this new leg up, we will be satisfied.

I'm looking, at least, for a relative underperformance of technological and homebuilders stocks comparing to traditional big caps. On the other hand this wave should mark the highest point of price and optimism for inflation related stuff, like EM stocks/bonds and for precious metals sector as well: "Hey guys, we're facing a hyper(re)inflation, no?"

Yelnick and a lot of other elliottists have reiterated recently "last chance to exit" calls, but no chance, we haven't entered the first wave down, yet, - it's only a zig zag correction. Indeed, it would be surprising to start a new leg down a priori without any notable non confirmation signs. Hopefully, during this new leg up, we will be satisfied.

I'm looking, at least, for a relative underperformance of technological and homebuilders stocks comparing to traditional big caps. On the other hand this wave should mark the highest point of price and optimism for inflation related stuff, like EM stocks/bonds and for precious metals sector as well: "Hey guys, we're facing a hyper(re)inflation, no?"

Friday, October 2, 2009

Is volatility turning up?

So, yesterday's start of 4Q has given some clarification about where we go.

First of all, the VIX (implied volatility) has closed above 100 DMA, first time since the beginning of this rally.

Homebuilders index has closed bellow the previous lows of August and September.

On the other side, Gold and Silver still looks good, showing the potential of new highs in the nearest future.

So, I'm sticking to my current opinion from the previous post about the NASDAQ and most markets in general. We should have some more upside movements, however some non confirmations will show up.

First of all, the VIX (implied volatility) has closed above 100 DMA, first time since the beginning of this rally.

Homebuilders index has closed bellow the previous lows of August and September.

On the other side, Gold and Silver still looks good, showing the potential of new highs in the nearest future.

So, I'm sticking to my current opinion from the previous post about the NASDAQ and most markets in general. We should have some more upside movements, however some non confirmations will show up.

Thursday, October 1, 2009

Will Nasdaq push above 200 weeks moving average?

As we can see on the chart below, Nasdaq Composite is sitting near the critical juncture. Will this rally be able to push prices significantly above 200 WMA?

In my current opinion, we will stabilize in the 2200-2270 range and start a new leg down somewhere at the beginning of 2010.

In my current opinion, we will stabilize in the 2200-2270 range and start a new leg down somewhere at the beginning of 2010.

Subscribe to:

Posts (Atom)