This morning in Europe we have tested yesterday's highs on March's SPX contracts at 1112.75, the same time NDX's ones have missed previous high by about 2 points. Also we've seen a sharp rally in all currencies against USD, bringing USD index to its trend line going since mid January.

The price action which actually followed suggests that we have finally rolled over and, at present, entering new phase of dollars appreciation and sell-offs in all classes of risky assets.

This scenario will be validated by crossing 81.5 on the USD index.

Tuesday, February 23, 2010

Friday, February 19, 2010

Gap and run

The tittle of my post is the program for today's session in the stock market. Yesterday's one proved just merveilleusement my EW count. NDX has stopped right at 61.8% retracement of the intermediate wave 1.

After market FED's announcement proves that they have good EW analysts as well. In any case, the message is pretty clear: "drop stocks, currencies, commodities and run on treasuries". So, don't fight the FED.

After market FED's announcement proves that they have good EW analysts as well. In any case, the message is pretty clear: "drop stocks, currencies, commodities and run on treasuries". So, don't fight the FED.

Wednesday, February 17, 2010

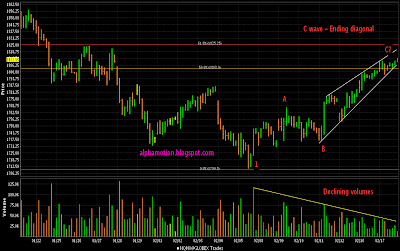

The start of the big drop tomorrow

I was wrong big time on the ending of the correction. Hopefully Mister Market always clarifies its course. My version is below, the most likely outcome is the start of the 3d wave down tomorrow. The ending diagonal seems to be about complete.

Friday, February 12, 2010

Correction is about over?

The correction which has started last Friday has a good chance to finish today. My target for SPX is 1083 and for NDX 1785. EUR/USD continue to be weak, confirming my previous call on euro. The next week should be strong on the downside for all risky assets.

Monday, February 8, 2010

Uncertainty, once again

Friday's session has put under the test my opinion about the structure of current decline. Today should be critical. Will we slow down and roll over under the red line or will we go higher, until the really important resistance of 1104 (for SPX). I'll be watching the leaders (techs), once again.

For the moment, I'm sticking with the previous count. However the target of this 3d wave may be much lower than 1000 for SPX and 2000 for Nasdaq.

For the moment, I'm sticking with the previous count. However the target of this 3d wave may be much lower than 1000 for SPX and 2000 for Nasdaq.

Saturday, February 6, 2010

A possible path for EUR/USD

After breaking down a 1.375 support EUR/USD has signaled the change in the long term trend. We can consider that 1.2 level will be reached before we will see 1.45.

Friday, February 5, 2010

Fast and furious

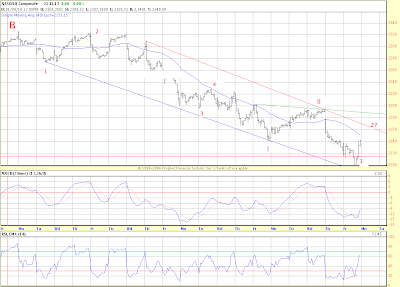

In the not so distant past the market was taking its time to correct. After a 1st wave, we could expect 50 to 62 percent of retrace in time as well as in price. Not this time. We have really entered a liquidation mode. We're in hurry to liquidate all this "risky" stuff we've hoarded since the beginning of March '09.

So, yesterday (Feb, 4) we have completed the first minute wave (1105 -> 1063 for SPX) of the 3d minor. Usually, the third waves are strong and often extend. So a reasonable target for this minor one could be at near or below 1000 on SPX and 2000 on the Nasdaq Composite. We'll reach the bottom of this third very quickly, most likely next week.

So, yesterday (Feb, 4) we have completed the first minute wave (1105 -> 1063 for SPX) of the 3d minor. Usually, the third waves are strong and often extend. So a reasonable target for this minor one could be at near or below 1000 on SPX and 2000 on the Nasdaq Composite. We'll reach the bottom of this third very quickly, most likely next week.

Subscribe to:

Posts (Atom)