The very important currency pair AUD/USD may be signalling an imminent end of the correction and the start of the year end rally. The top around 1.05-06 may be a very long term one, but for the moment, let's forget all the future austerity programs and chinese inflations.

Wednesday, November 24, 2010

Tuesday, November 9, 2010

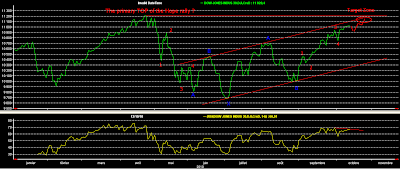

Make your choice Neo: red our blue

2 possible midterm scenario: blue and red one. I don't take in account an outcome where Bernanke wins and we get the DGDF (Dollar Goes Down Forever).

I prefer the red one, where the world economy as well as Bernanke's credibility (if there is still any) will be killed by high commodities prices.

I prefer the red one, where the world economy as well as Bernanke's credibility (if there is still any) will be killed by high commodities prices.

Tuesday, October 19, 2010

Short term USD index, update

The current count for USD index is confirmed, I think there are pretty good chances the dollar has bottomed, but I'd like to see some more upside action before the correction starts:

Thursday, October 14, 2010

The short-term USD index

The previous count of EUR/USD is still valid. Here is an USD index count, which has a clearer stucture:

Wednesday, October 13, 2010

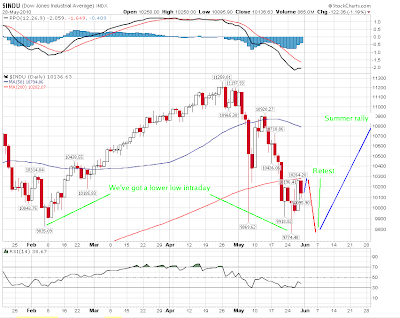

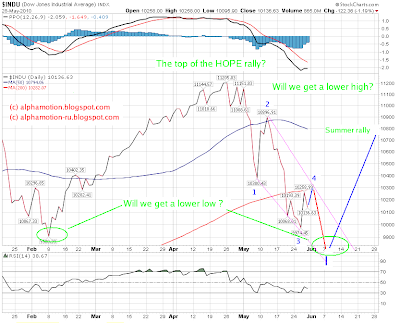

DJIA short term update

The market seems to be in the final 5th wave of the move started in late August.

And the fuel (fear ) is burning out quiet fast:

And the fuel (fear ) is burning out quiet fast:

Friday, October 8, 2010

Thursday, September 23, 2010

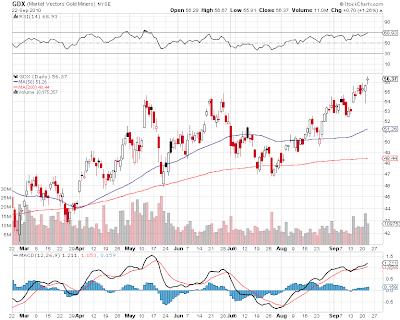

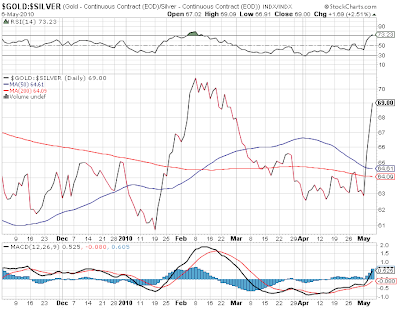

The moment of truth for PM is coming

Let's see if gold stocks and silver will be able to confirm the gold rally. The high of 2008 is at about 57 :

For the silver we're close to the 2008 high too:

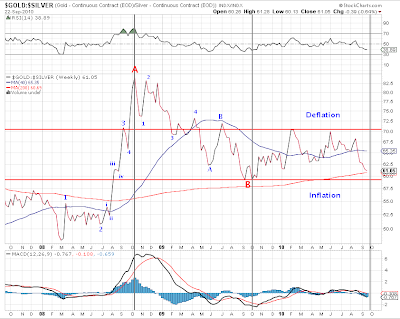

Is Ben really almighty as he may pretend and can change natural lows of deflation and inflation:

The coming days are really important and will show the direction for the future market action not only in the PM sector.

For the silver we're close to the 2008 high too:

Is Ben really almighty as he may pretend and can change natural lows of deflation and inflation:

The coming days are really important and will show the direction for the future market action not only in the PM sector.

Friday, September 10, 2010

Tuesday, September 7, 2010

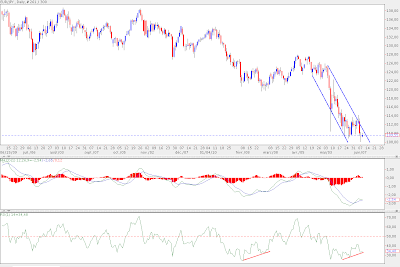

Short term EUR/USD

The final version of the summer corrective rally is shown bellow. Nothing new, except that the C wave of the correction has developed as a zig zag and not a 5 I've been looking for. As for me, that had a cost of about 100 pips of missed profit.

So, now, I'm pretty sure that we've entered the 3d minute wave down with the target of at least 1.215. The crossing of 1.2587 will confirm the move and if ever we manage to bounce back ant take the 1.2922 resistance we shouldn't go higher than 1.31 level.

So, now, I'm pretty sure that we've entered the 3d minute wave down with the target of at least 1.215. The crossing of 1.2587 will confirm the move and if ever we manage to bounce back ant take the 1.2922 resistance we shouldn't go higher than 1.31 level.

Thursday, August 5, 2010

AUD/USD: the end is nigh

My best guess for an important, as for the stock market, currency pair: AUD/USD.

It seems that we're near the end of the correction, more precisely in the C which has the form of the ending diagonal. I estimate the end of this wave and thus of the entire correction at 0.9246

It seems that we're near the end of the correction, more precisely in the C which has the form of the ending diagonal. I estimate the end of this wave and thus of the entire correction at 0.9246

Thursday, July 29, 2010

An important junction on EUR/USD

EUR/USD is approaching an important junction, shown on the chart. The upper trend line before we crashed in May's panic and the 38% retrace of the entire move from 1.515 to 1.188. Moreover this resistance level is consistent with my short term Elliott Wave count.

As for the US index that level of EUR/USD will give 81.2-81.4 that is a 50% correction of the whole index's move from November '09 lows to June's '10 highs.

As for the US index that level of EUR/USD will give 81.2-81.4 that is a 50% correction of the whole index's move from November '09 lows to June's '10 highs.

Thursday, July 22, 2010

Short term EUR/USD. Update.

The 3d of the C was a shortened one, we didn't reach what could be called a "~1.31" level. Then the parallel trend line was busted, but we didn't reach the level of the 1st of C, that gives a possibility to go a bit higher, say to 1.31 or some more. The RSI should not confirm that move.

Saturday, July 17, 2010

Short term EUR/USD

So, no surprise, we're in the red scenario. I should recognize, it's a bit more rapid than I would have expected, but never mind, the corrections are always fast and furious. And we've just passed the strongest part of it - the 3d of the 3d of the C.

The count and the projections are shown on the chart:

The count and the projections are shown on the chart:

Thursday, July 8, 2010

Possibilities

It's quiet difficult to say at the moment what are we correcting in EUR/USD. Is it the whole move started in late November '09, or rather just its crashing part of April-May. That's why, I include 2 wave counts:

Looking at other European currencies, doesn't give much more clarification. In any case the pound seems to be close to the end of its correction, whatever it eventually is.

And as for the swiss frank, it's clear that we're correcting the entire move, but that doesn't mean, the next move up will hit the new highs. The dollar may easily put new cyclical highs versus pound and euro without doing so versus frank, if, of course, we follow the green count on the EUR/USD.

Looking at other European currencies, doesn't give much more clarification. In any case the pound seems to be close to the end of its correction, whatever it eventually is.

And as for the swiss frank, it's clear that we're correcting the entire move, but that doesn't mean, the next move up will hit the new highs. The dollar may easily put new cyclical highs versus pound and euro without doing so versus frank, if, of course, we follow the green count on the EUR/USD.

Wednesday, June 30, 2010

Friday, June 18, 2010

Tuesday, June 15, 2010

Medium term projection for EUR/USD

The following projection of EUR/USD behavior considers that the correction of the first wave down in the US equity markets will be done by mid or end of July. The August, in this case, will be really hot with the 3d wave down for the equities and the 5th for the euro.

Thursday, June 10, 2010

Is the final capitulation on euro still ahead?

I think the set-up is quiet good for the final capitulation on the euro. On EUR/USD that should be at around 1.175-1.18

The risk is back

Market has tried to rally and was sold in a controlled manner during the second part of the yesterday's session. But looking in the details one will remark that risk is starting to enter by a small door. Small caps were clear performers. Commodity currencies were strong as well as East European ones. The implied volatility as well as it expectation (VXX and contracts on VIX) were about unchanged.

As for the moment I'd expect one more close near the recent lows for the broad US indexes as well as for other risk plays (EUR/JPY, EUR/CHF) before we start the summer risk rally.

As for the moment I'd expect one more close near the recent lows for the broad US indexes as well as for other risk plays (EUR/JPY, EUR/CHF) before we start the summer risk rally.

Wednesday, June 9, 2010

A turning point?

May be we have seen the turning point today and the beginning of the summer rally. In any case my trend lines for IYT (Dow Transport) and Intel have worked just fine. XHB and R2K have gotten a bit lower, but have preserved with a good margin their February's lows. Financials were strong, that is bullish.

In my opinion, this week and even may be tomorrow will be decisive.

In my opinion, this week and even may be tomorrow will be decisive.

Tuesday, June 8, 2010

The 5th is the 5th

So, yesterday we've closed at multi months lows on DJIA and SPX thus confirming my view and the possible trend reversal.

A good indicator to watch is the old good EUR/JPY. Technically it's rather constructive.

A good indicator to watch is the old good EUR/JPY. Technically it's rather constructive.

Saturday, June 5, 2010

Monday, May 31, 2010

Some ideas about the market's medium term future

Last Tuesday (in US it still was Monday) I've posted the projection on how the markets could behave with some US sectors and individual stocks during the nearest future in the russian part of the blog. The main idea behind this projection is the fact that US markets are entering the period of the broad top formation for the whole rally which started from the March '09 lows. In this context, there is high probability that many individual stocks have already put their cyclical tops in and are in early stages of decline. The same thing may be true even for major broad indexes (SPX, Dow Industrial). But what was clear at that point for me, it's that some important individual stocks, secondary indexes and even the Dow Transport were still strong ans able to refresh the new cyclical highs before the things really roll over. So, as for example, I've cited just few of them:

Russel 2000, XHB (homebuilders ETF), IYT (Dow Transport ETF) and INTC (Intel Corp). All of them seems to be on the road to complete the expanding triangle pattern:

Since that post, the defined supports were touched on 3 of 4 (INTC missed by about 30 cents). Market has rallied strong and many pundits have declared the correction over.

I'm not sure the things are so simple, especially for the broad indexes like SPX or Dow Industrial.

Let's take the latter. If we look at the candle charts, the move since late April looks more corrective than not.

But if we take the close price only, things are much clearer. And they will become even more clear, should we retest the last Tuesday's lows, especially closing near them. In this case we'll have a 5 waves decline on the close basis, meaning, from the point of view of classical Elliott wave principles, that the trend for the Dow Industrial has changed. But, since many other narrow indexes are still looking bullish , the rally in DOW will be long with a deep retrace. May be, at the top, we will see the case of the Dow theory non confirmation : new highs on Transport with the failed Industrial.

Russel 2000, XHB (homebuilders ETF), IYT (Dow Transport ETF) and INTC (Intel Corp). All of them seems to be on the road to complete the expanding triangle pattern:

Since that post, the defined supports were touched on 3 of 4 (INTC missed by about 30 cents). Market has rallied strong and many pundits have declared the correction over.

I'm not sure the things are so simple, especially for the broad indexes like SPX or Dow Industrial.

Let's take the latter. If we look at the candle charts, the move since late April looks more corrective than not.

But if we take the close price only, things are much clearer. And they will become even more clear, should we retest the last Tuesday's lows, especially closing near them. In this case we'll have a 5 waves decline on the close basis, meaning, from the point of view of classical Elliott wave principles, that the trend for the Dow Industrial has changed. But, since many other narrow indexes are still looking bullish , the rally in DOW will be long with a deep retrace. May be, at the top, we will see the case of the Dow theory non confirmation : new highs on Transport with the failed Industrial.

Labels:

Dow Industrial,

DOW Transportation,

Elliott Count,

Intel,

IYT,

R2K,

XHB

Friday, May 28, 2010

The setup for EUR/USD is good

By establishing the double bottom at around 1.215 EUR/USD confirms my positive opinion and EW count and validates the target of 1.32+ in coming weeks. This target is confirmed as well by the price action in GPB/USD and equities.

Thursday, May 27, 2010

Bottoming

So, in my opinion, we're in the process of bottoming.

Despite the strong performance of the european markets end US futures this morning, be aware of a highly probable pull back to test the Tuesday's low. In my opinion, that will be an excellent entry point if you're not already in.

Despite the strong performance of the european markets end US futures this morning, be aware of a highly probable pull back to test the Tuesday's low. In my opinion, that will be an excellent entry point if you're not already in.

Monday, May 24, 2010

Commodities priced in euro are breaking down as well

Well, the euro seems to be stabilizing. May be some more days of shaking out weak hands, and we will climb higher, toward, at least, 1.32-35.

One of the tings supporting the single currency, I see, is the beginning of the commodities decline. The CRB priced in euro has rolled over, just as it did before in USD:

One of the tings supporting the single currency, I see, is the beginning of the commodities decline. The CRB priced in euro has rolled over, just as it did before in USD:

Thursday, May 20, 2010

Good bye, carry trade!

Euro has finally started to show some resiliency after yesterday's rally. Isn't surprising?

The chart of EUR/AUD is speaking by its self:

The chart of EUR/AUD is speaking by its self:

Thursday, May 13, 2010

Friday, May 7, 2010

Fat fingers?

May be, may be not, after all it's not that important:

The Gold/Silver ratio is surging 3d day in a row:

And what's about US treasuries, they were already rallying for some weeks:

So, was it really because of a fat finger?

The Gold/Silver ratio is surging 3d day in a row:

And what's about US treasuries, they were already rallying for some weeks:

So, was it really because of a fat finger?

Labels:

Elliott Count,

Gold,

Market Trend,

Silver,

T-Bonds

Tuesday, May 4, 2010

Precious metals: time to get out

Gold and silver were in the uptrend since the beginning of February. But it seems their run up was a mere correction which is about to be done.

Gold has corrected 78% of its initial decline since December '09.

The move down will be confirmed after the breach of the low trend line (now at about 1130):

As for the silver, the story is about the same, except that the correction was a bit deeper.

And as for the broad market, the drop of PMs will be anything but bullish.

Monday, May 3, 2010

Thoughts about the primary trend

An excellent analyses about the current market from Claassen Research.

They explain with historical charts and data why we shouldn't pay too much attention to the market's internals. This time it's really different and is similar to the previous bear market rallies.

A must read.

They explain with historical charts and data why we shouldn't pay too much attention to the market's internals. This time it's really different and is similar to the previous bear market rallies.

A must read.

Tuesday, April 27, 2010

The 2nd wave down is already on, just look in the right direction

While Wall Street is pushing higher every single day on the upbeat earnings, let's look what is going on on the other side of the Atlantic ocean. Greek, Portuguese, Spanish and Italian equity indexes are below.

Just wondering, if the size of US government debt ever become an issue, will the reaction of Wall street be the same as in Greece?

Just wondering, if the size of US government debt ever become an issue, will the reaction of Wall street be the same as in Greece?

Monday, April 12, 2010

Is it it?

Great news, they have finally did it! Great news for the Euro bears in the long run, but a bit of pain for the moment. May be, again until 1.3850.

Meantime AUD/USD has flashed a big sell signal this morning dropping after a gap up in the clear 5-wave pattern. We have missed by 16 pips the Nov' 09 recovery high. Is it the end? Will AUD be joined by its peers CAD and silver in coming days?

Meantime AUD/USD has flashed a big sell signal this morning dropping after a gap up in the clear 5-wave pattern. We have missed by 16 pips the Nov' 09 recovery high. Is it the end? Will AUD be joined by its peers CAD and silver in coming days?

Thursday, April 8, 2010

Will Greece freeze Eastern Europe's credit markets?

Are we heading to the contagion of Greece problems to Eastern Europe and other PIGS? If even greek citizens don't believe in their country's financial system by pulling out their savings by billions, who ever will? In my opinion the game over for the whole region is starting to loom.

Friday, April 2, 2010

USD index: consolidation

It seems we have entered the consolidation mode on USD index. Our position comparing to the previous dollar's wave up is on the chart. I would suggest that the next wave up for the USD index will involve all major currencies as well as precocious mettals. May be, from the fundamental point of view, it will be provoked by the change of FED's language after some signs of "improved" economy.

Subscribe to:

Posts (Atom)