On wednesday USD has failed to break out after a good start in the american session. In my opinion, the current correction may go toward 100 days MA (moving average) with a strong support at 50 days MA around 76.

Thursday, December 31, 2009

Wednesday, December 23, 2009

The precious metals weakness

Precious metals are weak these times, breaking my preferred support levels of 108-109 on the ETF (GLD). Silver on Tuesday has confirmed the gold persistent weakness putting in a new low since this wave down has started. So, for now I'm considering highly probable the test of 100-102 range for the ETF GLD (1010-1030 for physical) and the down trend line (at 14.90) for the silver.

This impulse down bodes well with an expected continuation of the dollar strength. I don't see any meaningful correction before 81 is reached.

This impulse down bodes well with an expected continuation of the dollar strength. I don't see any meaningful correction before 81 is reached.

Friday, December 18, 2009

Tuesday, December 15, 2009

Risk aversion: another indicator

In a previous post I've already discussed one of my favorite risk aversion indicator in equity space : the Nasdaq to Dow ratio. Now I'd like to watch another important ratio: small capitalizations vs big ones. Small caps, as asset class, are considered to be more vulnerable to a recession, since they have more difficulties to get an access to cheap financing. Therefore, if we, as I expect, are heading in the 2nd dip of W-shaped recession, the small caps should show some weakness.

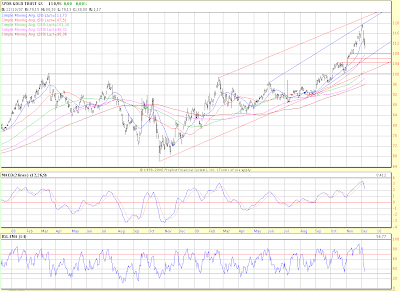

And it's what they do on the chart bellow. The charts shows the ratio of Russel 2000 (2000 medium to small capitalizations) to SP100 (hundred biggest US caps).

As we see, the rally off its lows has started well before the indexes their-self did it. And it has ended mid-September, a bit less than 10 months later. Since,we have drown a regular 1st wave down, signaling from the Elliott waves perspective the trend change.

If we apply the time the rally in the risk appetite has lasted to the SP500 or Dow indexes, we'll get the projection of their top for the year end, once again.

And it's what they do on the chart bellow. The charts shows the ratio of Russel 2000 (2000 medium to small capitalizations) to SP100 (hundred biggest US caps).

As we see, the rally off its lows has started well before the indexes their-self did it. And it has ended mid-September, a bit less than 10 months later. Since,we have drown a regular 1st wave down, signaling from the Elliott waves perspective the trend change.

If we apply the time the rally in the risk appetite has lasted to the SP500 or Dow indexes, we'll get the projection of their top for the year end, once again.

Monday, December 14, 2009

The first wave UP

My view on USD has finally worked out. The trend has changed and we've completed the first wave up.

The puzzle of different markets is slowly starting to assemble. The retrace of this first wave up for the USD has an excellent chance to coincide with the top in equities. Indeed, after the Dubai's rescue, what an event may strike the self-confidence of the market participants: Eastern Europe? Don't care, IMF will fix it. The party must be going on! Until it's over.

The puzzle of different markets is slowly starting to assemble. The retrace of this first wave up for the USD has an excellent chance to coincide with the top in equities. Indeed, after the Dubai's rescue, what an event may strike the self-confidence of the market participants: Eastern Europe? Don't care, IMF will fix it. The party must be going on! Until it's over.

Wednesday, December 9, 2009

A view on the precious metals

In the precious metals complex, I'm watching closely 3 components : gold, silver and the gold bug index HUI. Until the recent sell-off, the three have advanced more or less synchronously. Moreover, the run in the precious metals that preceded was real not only in US dollars, meaning the investors are scared of the (hyper)inflation on the global scale.

As the dollar has started to gather some strength, these hedges have been thrown away. But, as far as we continue to stay in "corrective mood" in the broad market, the things are, in my opinion, not done, especially for gold. The yellow metal's sell-off is looking much as a correction and I would expect gold to reverse from 108-109 range to push higher at the beginning of New Year as high as 126-132 for the ETF (GLD) or 1270-1330 for cash. Indeed, I would expect gold to make new historical highs as we enter the initial phase of the new wave down for stock indexes, it was already the case in the 4Q 2007 and 1Q 2008.

As the dollar has started to gather some strength, these hedges have been thrown away. But, as far as we continue to stay in "corrective mood" in the broad market, the things are, in my opinion, not done, especially for gold. The yellow metal's sell-off is looking much as a correction and I would expect gold to reverse from 108-109 range to push higher at the beginning of New Year as high as 126-132 for the ETF (GLD) or 1270-1330 for cash. Indeed, I would expect gold to make new historical highs as we enter the initial phase of the new wave down for stock indexes, it was already the case in the 4Q 2007 and 1Q 2008.

For the gold miners and the silver, the things are much trickier. They are more sensitive to the prospects of the broad stock market. And, in my opinion, they are far from being bright at this point.The gold bug index has stopped its advance right before the top of 2008, rising the probability of the double top.

The silver has reversed right under its Jul 08 minor top, nearly my preferred level of March 08 gap (19.40). I must say, that the whole advance in silver and HUI looks to me as corrective, since I can't rule out that their declines from the March 08' was in impulsive way.

So, my conclusion: the gold is very certainly correcting and will take new highs in the beginning of the 10', pushed by the deflationary forces. We may have the situation where gold and dollar move in the same direction. As for the gold stocks and silver, the situation is not easy, at least they will lag gold, creating the situation of non-confirmation.

Monday, December 7, 2009

Risk appetite and some confirmation

I've been expecting the techs to underperform the broad market and especially big caps well before the markets start to roll over. And that's what we have had.

On the chart bellow we see the Nasdaq Composite to Dow Industrial Average ratio. It reflects the willingness of investors to buy riskier (more expensive on the relative basis) growth stocks. This ratio has put a top at the end of September and since, it has declined in the clear 5 waves pattern, meaning, from the Elliott waves point of view, the trend has changed.

So the rally in "risk appetite" has lasted a bit less than 10 months, and hence it confirms the coming reversal in the major averages (SPX, DOW) which will mark at the same time the beginning of the 3d wave down for the Nasdaq to Dow ratio.

Thursday, December 3, 2009

Want a bigger sallary? Pay back your debt.

While markets seemed to be happy with the news of BoA paying back government bailout funds, I think this event is not inflationary, especially for the dollar, - money are taking off the table and go back to their creator.

And, naturally, it's a good way to motivate other bank executives: "Wanna more money, pay back your debt".

And, naturally, it's a good way to motivate other bank executives: "Wanna more money, pay back your debt".

Santa rally, really?

What an entertainment to see bears turning bulls after the 60% rally. Yelnick has called "Wolf!" some times already since at least September, but finally he's calling for the Santa rally to the year end, and may be until February.

Oh, yeah, I understand, it's quite difficult to track any Elliott waves in the corrective crap the SPX or DOW are made of, so we start to imagine it was just an accumulative phase and we gonna explode on the upside.

Meantime, I don't see any reason for the averages to accelerate hence there are virtually no bears in the woods to hunt. Or, may be, still Pretcher, if he calls to cover his double short position, I will immediately put in the mine.

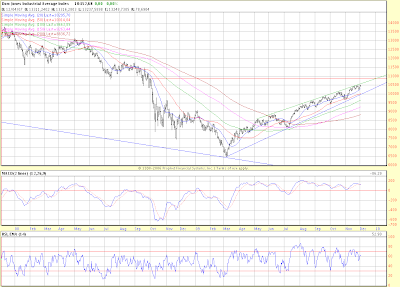

The best illustration is provided by the DOW: he's well as he is, drifting higher under the green line, enjoying the last weeks of this indian summer.

Oh, yeah, I understand, it's quite difficult to track any Elliott waves in the corrective crap the SPX or DOW are made of, so we start to imagine it was just an accumulative phase and we gonna explode on the upside.

Meantime, I don't see any reason for the averages to accelerate hence there are virtually no bears in the woods to hunt. Or, may be, still Pretcher, if he calls to cover his double short position, I will immediately put in the mine.

The best illustration is provided by the DOW: he's well as he is, drifting higher under the green line, enjoying the last weeks of this indian summer.

Labels:

Dow Industrial,

Elliott Waves,

Market Sentiment,

Market Trend

Wednesday, December 2, 2009

A tough call

In the time of rush on gold, I'd like to share my call on Silver:

We gonna put a top in coming days under the 08' highs, the most likely around 19.40 for the ETF (SLV). This top has a very good chance to stay for more than a year, and if the markets plunge in the second wave of deflation, as I expect, we'll see silver under 08' October's lows of 8.50.

We gonna put a top in coming days under the 08' highs, the most likely around 19.40 for the ETF (SLV). This top has a very good chance to stay for more than a year, and if the markets plunge in the second wave of deflation, as I expect, we'll see silver under 08' October's lows of 8.50.

Tuesday, December 1, 2009

A small check-up

It's how I would call the sell-off in risk assets that has followed Dubai's announcement. As a result of this check-up, - everything is in place and working: firstly sell emerging countries debt, stocks and currencies, simultaneously buy dollar and contracts on US government bonds. Fine, mission accomplished!

By its self, even the Dubai's default is far from being able to put in danger the world's financial system as it was the case with Lehman Brothers. What is more important it's the reminder to an average investor: "Ok, here in US, Europe, Japan, things are ugly and you can't earn anything on your money, but be careful when you go outside! Even if it looks great (as Dubai did) it can hurt badly and you'll loose about everything."

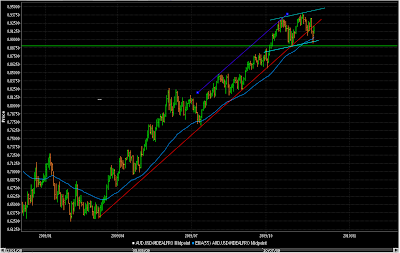

Now let's look at currencies. Bellow are two of them : the Euro, something like a big cap (of DOW Industrial index) and a "high beta small cap" - Australian dollar. And in this space the flight to quality is obvious.

As we can see for EUR/USD, the sell-off wasn't able to push bellow the red trend line. It's certainly a sign of strength and resilience for the single currency. Until this trend line resists we're still able to push higher, toward the upper trend line (1.537) . And seeing what is happening with gold, I consider it as a high probability event.

As for the Aussie, I'm happy that my call was confirmed. We have pierced and later busted the supportive red trend line as well as 55 days exponential moving average. That's serious. While AUD/USD have to go under 0.89 to confirm it's down trend, I think, before, it may take some time to consolidate in the 0.89-0.94 range.

By its self, even the Dubai's default is far from being able to put in danger the world's financial system as it was the case with Lehman Brothers. What is more important it's the reminder to an average investor: "Ok, here in US, Europe, Japan, things are ugly and you can't earn anything on your money, but be careful when you go outside! Even if it looks great (as Dubai did) it can hurt badly and you'll loose about everything."

Now let's look at currencies. Bellow are two of them : the Euro, something like a big cap (of DOW Industrial index) and a "high beta small cap" - Australian dollar. And in this space the flight to quality is obvious.

As we can see for EUR/USD, the sell-off wasn't able to push bellow the red trend line. It's certainly a sign of strength and resilience for the single currency. Until this trend line resists we're still able to push higher, toward the upper trend line (1.537) . And seeing what is happening with gold, I consider it as a high probability event.

As for the Aussie, I'm happy that my call was confirmed. We have pierced and later busted the supportive red trend line as well as 55 days exponential moving average. That's serious. While AUD/USD have to go under 0.89 to confirm it's down trend, I think, before, it may take some time to consolidate in the 0.89-0.94 range.

Subscribe to:

Posts (Atom)