The stock market had only good news on Friday with Q4 GDP, Chicago PMI and consumer sentiment, all shooting higher than was expected. But the stocks faded, especially in tech sector. And if someone thinks the decline in stocks was driven by an expectation of the future rise in interest rates, he must look at treasuries. Their rates have declined strongly, - not exactly a situation of eminent rise in FED funds.

All this has given one more proof, if one needed, that markets aren't driven by news.

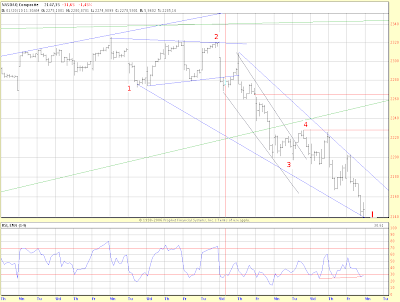

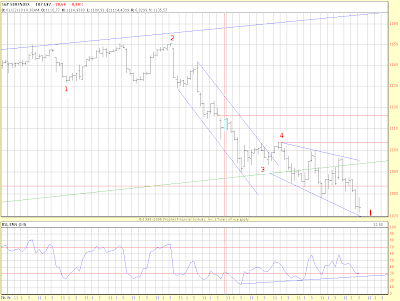

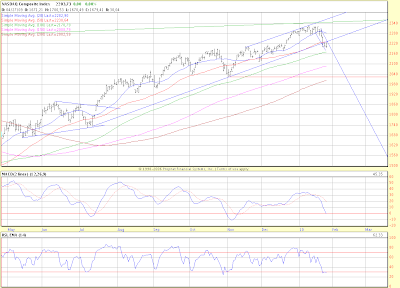

In my opinion we have approached the end of the first minor wave down, as shows my Elliott Wave count for Nasdaq and SPX:

I'd like to add that I consider the beginning of the first minute wave January 11, the same day as for Nasdaq. Indeed, even if we can't see it on the charts of cash SPX, the March's contracts on SPX, have put in the absolute top right before the bell on the January 11. That top wasn't taken off when 2nd minute wave topped out. Thus, one of the most important rules of the Elliott Wave Principle ("Wave 2 can never exceed the start of Wave 1") is preserved.

The obvious conclusion of this count : the most likely, this Monday (February 1st) we'll start a corrective rally. The possible targets for this move are shown by red horizontal lines.

Sunday, January 31, 2010

Wednesday, January 27, 2010

Should I stay or should I go?

This week, market is seeking to stabilize after last Friday's sell off. It's difficult to be sure in very short picture. We can push much lower today (my privileged call), in which case it will be the 5th minor wave of the 1st down, as well as we can stay in the range of previous 2 days or slightly rally in order to work out short term oversold conditions.

Let's look where this market is heading in the nearest perspective.

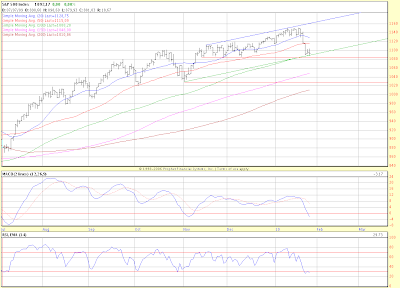

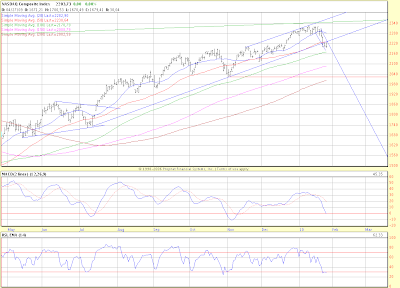

In my opinion, both SP500 and Nasdaq Composite are heading to test (and pierce) their 200 days MA.

And that should happen within weeks. After that, we'll certainly have a tradeable rebound and then the real things will be able to start. Currently I think that we will start the new Big Wave down somewhere in April heading in what Yelnick has called the Summer of Disillusionment.

Let's look where this market is heading in the nearest perspective.

In my opinion, both SP500 and Nasdaq Composite are heading to test (and pierce) their 200 days MA.

And that should happen within weeks. After that, we'll certainly have a tradeable rebound and then the real things will be able to start. Currently I think that we will start the new Big Wave down somewhere in April heading in what Yelnick has called the Summer of Disillusionment.

Friday, January 22, 2010

Don't wake a hungry bear!

I should note that equity market was greatly prepared for the yesterday's sell-off.

From the technical point of view, we have passed the 10 months time frame, which is 62% duration of the previous bear market.

Fundamentally, we're in the 3rd quarter of upbeat earning reports and given the 60%+ rally, the cost reducing efforts of US companies are at present more than fully discounted by the market. What we need to hold, not speaking about the rise, is the growth of sales, that means a real, consumer driven recovery. But the unemployment, which is rising along with cost cutting programs, can't provide any confidence to the consumers.

On the political front, Democrats have lost an important election, and it's not a good thing in the mid-term elections year. That's why in order to gain some popularity, Obama has to do things which will please its voters. And what else will be more popular than an exemplar punishment of the authors of the current crisis. The same who were responsible during decades for pumping money in to the system. All this is deflationary and mister market feels it.

On the short term charts I've got an impression that we need, at least, one more wave down for SPX as well as for NASDAQ. Moreover, it's highly probable that one of these indexes if not both has put its top in.

And, in my opinion, we have a similar situation with currencies. In order to complete the pattern EUR/USD has to plunge one more time, probably toward 1.38.

In any case, we're only at the beginning of the second (3d in Elliott Waves terms) wave of dollar appreciation.

Thursday, January 21, 2010

Precious metals looks like ready to plunge

During some days the strengthening dollar didn't do much on precious metals. That's true, the strength was mainly due to the euro weakness. Yesteryear, high-yielders like AUD have joined the party and we have finally had a sell-off in gold and silver. But, in the most important juncture we find the unhedged gold producers index HUI.

In the "real economy", IBM has reported its earnings and put aside a "better than expected", we note the drop in the consulting business revenue, - the clients of this IBM's unit don't want to invest in new contracts and sometimes aren’t resuming the old ones.

The GSR (Gold to Silver ratio) seems to be on the point to rally in more impulsive fashion than it did until now. And that, as we remember, is an obvious sign of mounting expectations of deflation.

In the "real economy", IBM has reported its earnings and put aside a "better than expected", we note the drop in the consulting business revenue, - the clients of this IBM's unit don't want to invest in new contracts and sometimes aren’t resuming the old ones.

Wednesday, January 20, 2010

Is the game over?

As I've been expecting, the EUR has started a sharp rally the day the payrolls data was published. Numbers was ugly, but market participants have justified buying by the supposed new stimulus package the Obama's administration would be supposed to launch later this year. OK, the rally has happened to be the correctional wave C of the first wave down for the EUR/USD (the wave up for the USD index).

The EUR/USD has broken this night the 1.4215 support provided by the bottom of the 1st wave. The main reason du jour, now, seems to be the defeat of democrats in the senatorial election in Massachusetts. I think it's pretty clear that electors send a message about administration's costly plans on health reform as well as about others possible stimulus packages. And given that we're in the mid-term election year, if democrats don't want to be hammered they will listen vox populi.

I wouldn't expect EUR/USD to fall off the cliff right now. Indeed other components like canadian or australian dollars still hold rather strong. So a sharp counter trend rally in EUR/USD is very likely before we really start to sink. And, of course, that rally shouldn't exceed the high of the wave C - 1.4580.

The EUR/USD has broken this night the 1.4215 support provided by the bottom of the 1st wave. The main reason du jour, now, seems to be the defeat of democrats in the senatorial election in Massachusetts. I think it's pretty clear that electors send a message about administration's costly plans on health reform as well as about others possible stimulus packages. And given that we're in the mid-term election year, if democrats don't want to be hammered they will listen vox populi.

I wouldn't expect EUR/USD to fall off the cliff right now. Indeed other components like canadian or australian dollars still hold rather strong. So a sharp counter trend rally in EUR/USD is very likely before we really start to sink. And, of course, that rally shouldn't exceed the high of the wave C - 1.4580.

Friday, January 8, 2010

Critical juncture for USD?

I've noted a pause of the USD rally at the end of 2009. Today with the US payrolls we have a good chance to choose a direction for the next move. Either we continue the correction (downward for USD index) but in more impulsive manner, either we break down the EUR/USD trendline, starting the new wave of the dollars appreciation. I give 70% for the first. In any case the status quo can't continue much longer.

Wednesday, January 6, 2010

XAL has finally taken off

Happy New Year for everyone and successful investing. To start with the positive mood, let's look at one very positive development.

I've discussed already the possible long term bottom in the air transports some months ago.

Despite recent terror menace airlines have hold very nice. I see a clear 5 waves impulsive pattern unfolding since the retest of March's 09 bottom, meaning airlines are probably the first US industry to get out of the bear market, well, after ...... at least 10 years and ~94% decline. It's pretty encouraging for other sectors, isn't?

I've discussed already the possible long term bottom in the air transports some months ago.

Despite recent terror menace airlines have hold very nice. I see a clear 5 waves impulsive pattern unfolding since the retest of March's 09 bottom, meaning airlines are probably the first US industry to get out of the bear market, well, after ...... at least 10 years and ~94% decline. It's pretty encouraging for other sectors, isn't?

Subscribe to:

Posts (Atom)