Last Tuesday (in US it still was Monday) I've posted the projection on how the markets could behave with some US sectors and individual stocks during the nearest future in the russian part of the blog. The main idea behind this projection is the fact that US markets are entering the period of the broad top formation for the whole rally which started from the March '09 lows. In this context, there is high probability that many individual stocks have already put their cyclical tops in and are in early stages of decline. The same thing may be true even for major broad indexes (SPX, Dow Industrial). But what was clear at that point for me, it's that some important individual stocks, secondary indexes and even the Dow Transport were still strong ans able to refresh the new cyclical highs before the things really roll over. So, as for example, I've cited just few of them:

Russel 2000, XHB (homebuilders ETF), IYT (Dow Transport ETF) and INTC (Intel Corp). All of them seems to be on the road to complete the expanding triangle pattern:

Since that post, the defined supports were touched on 3 of 4 (INTC missed by about 30 cents). Market has rallied strong and many pundits have declared the correction over.

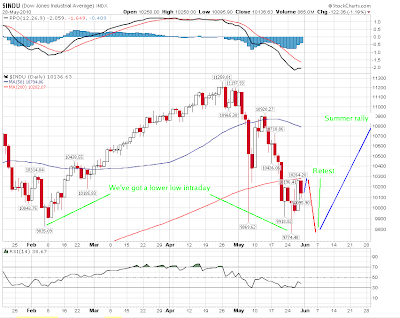

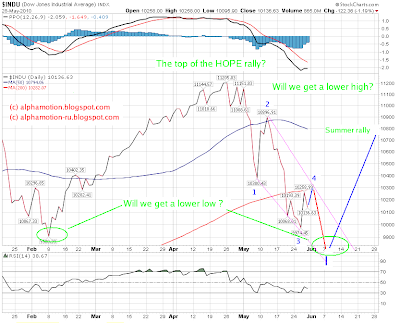

I'm not sure the things are so simple, especially for the broad indexes like SPX or Dow Industrial.

Let's take the latter. If we look at the candle charts, the move since late April looks more corrective than not.

But if we take the close price only, things are much clearer. And they will become even more clear, should we retest the last Tuesday's lows, especially closing near them. In this case we'll have a 5 waves decline on the close basis, meaning, from the point of view of classical Elliott wave principles, that the trend for the Dow Industrial has changed. But, since many other narrow indexes are still looking bullish , the rally in DOW will be long with a deep retrace. May be, at the top, we will see the case of the Dow theory non confirmation : new highs on Transport with the failed Industrial.

Monday, May 31, 2010

Friday, May 28, 2010

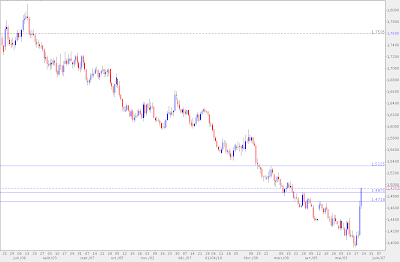

The setup for EUR/USD is good

By establishing the double bottom at around 1.215 EUR/USD confirms my positive opinion and EW count and validates the target of 1.32+ in coming weeks. This target is confirmed as well by the price action in GPB/USD and equities.

Thursday, May 27, 2010

Bottoming

So, in my opinion, we're in the process of bottoming.

Despite the strong performance of the european markets end US futures this morning, be aware of a highly probable pull back to test the Tuesday's low. In my opinion, that will be an excellent entry point if you're not already in.

Despite the strong performance of the european markets end US futures this morning, be aware of a highly probable pull back to test the Tuesday's low. In my opinion, that will be an excellent entry point if you're not already in.

Monday, May 24, 2010

Commodities priced in euro are breaking down as well

Well, the euro seems to be stabilizing. May be some more days of shaking out weak hands, and we will climb higher, toward, at least, 1.32-35.

One of the tings supporting the single currency, I see, is the beginning of the commodities decline. The CRB priced in euro has rolled over, just as it did before in USD:

One of the tings supporting the single currency, I see, is the beginning of the commodities decline. The CRB priced in euro has rolled over, just as it did before in USD:

Thursday, May 20, 2010

Good bye, carry trade!

Euro has finally started to show some resiliency after yesterday's rally. Isn't surprising?

The chart of EUR/AUD is speaking by its self:

The chart of EUR/AUD is speaking by its self:

Thursday, May 13, 2010

Friday, May 7, 2010

Fat fingers?

May be, may be not, after all it's not that important:

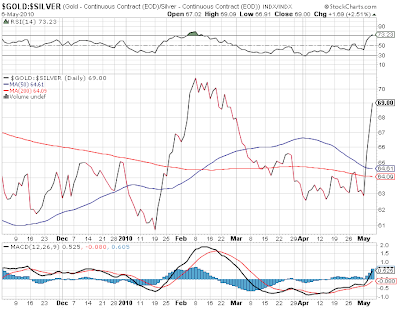

The Gold/Silver ratio is surging 3d day in a row:

And what's about US treasuries, they were already rallying for some weeks:

So, was it really because of a fat finger?

The Gold/Silver ratio is surging 3d day in a row:

And what's about US treasuries, they were already rallying for some weeks:

So, was it really because of a fat finger?

Labels:

Elliott Count,

Gold,

Market Trend,

Silver,

T-Bonds

Tuesday, May 4, 2010

Precious metals: time to get out

Gold and silver were in the uptrend since the beginning of February. But it seems their run up was a mere correction which is about to be done.

Gold has corrected 78% of its initial decline since December '09.

The move down will be confirmed after the breach of the low trend line (now at about 1130):

As for the silver, the story is about the same, except that the correction was a bit deeper.

And as for the broad market, the drop of PMs will be anything but bullish.

Monday, May 3, 2010

Thoughts about the primary trend

An excellent analyses about the current market from Claassen Research.

They explain with historical charts and data why we shouldn't pay too much attention to the market's internals. This time it's really different and is similar to the previous bear market rallies.

A must read.

They explain with historical charts and data why we shouldn't pay too much attention to the market's internals. This time it's really different and is similar to the previous bear market rallies.

A must read.

Subscribe to:

Posts (Atom)